Content

Check the T&Cs to see if https://casinobonusgames.ca/instadebit/ the offer only applies to a certain game or title. Sometimes you can get a no deposit bonus to use on a table game such as blackjack, roulette, or poker. A key factor in our casino reviews is the ease of making a deposit for real money casino play. We want to ensure that each casino site we recommend has a variety of deposit methods and it is easy to deposit funds there. In this step, we also contact the customer support service of the site. We want to know for our own peace of mind that they respond quickly and have the answers to some key industry questions that we ask.

- When you get a free spin bonus, the casino adds a number of prepaid spins to your account.

- Unless the law changes, the bonus depreciation percentage will decrease by 20 points each year over the next several years until it phases out entirely for property placed in service after December 31, 2026.

- The 2017 tax law permitted a 100 percent bonus depreciation deduction for assets with useful lives of 20 years or less.

For property placed in service after September 10, 2001, only the depreciation deduction allowed under IRC §168 in effect on December 31, 2001 — exclusive of any amendments made subsequent to that date — is allowed.LAYes. The key to eligibility for any of these bonus depreciation percentages is ensuring that the assets are “placed in service” prior to specific deadlines. It’s not enough to simply purchase qualified property prior to Dec. 31, 2023. In order to qualify for 80percent bonus depreciation, those assets must be in service before the end of the year. The same will be true for each of the phase-out percentages in the years ahead — if the asset isn’t in service before the end of the year, it will only qualify for the following year’s bonus percentage amount. It is within the realms of the online casino – you can use it to play slots or other games for free.

No Deposit Bonus Codes For Existing Players

Unlike section 179 expensing, however, taxpayers do not need net income to take bonus depreciation deductions. Additional tax planning in relation to the new net operating loss limitations – as well as the new limitation on losses of noncorporate taxpayers – will be necessary in these situations. Further, bonus depreciation is not limited to smaller businesses or capped at a certain dollar level as under section 179, where larger businesses that spend more than the investment limitation on equipment will not receive the deduction. Lastly, the years in which full expensing is available may offset the impact where the section 179 deduction may not be allowed due to either the expensing or investment limitations. Arizona does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.

Bonus Depreciation Schedule And Phase Out

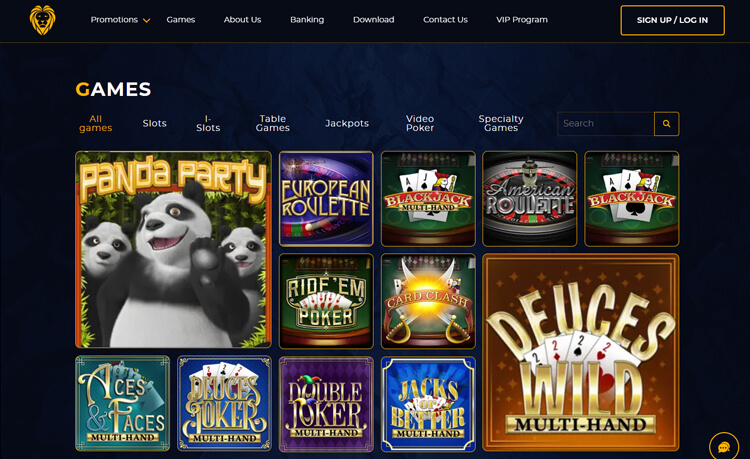

All of the recommended casinos here are legitimate sites that keep players safe. They respect gambling rules and age restrictions, offering an excellent real money gaming experience in a secure environment dedicated to players’ welfare and security online. We love to see free spins bonuses in the US because it gives players a chance to test a new casino out without having to wager any of their own money. You might encounter no deposit bonuses in different forms with the likes of Bitcoin no deposit bonuses.

For example, deposit bonuses are awarded to players for depositing real money into their casino account, whereas cashback bonuses give players a percentage of their losses back as bonus funds. If the taxpayer improved the property while they were leasing it, the improvements themselves will not be eligible for bonus depreciation, but the underlying property will be eligible. For depreciation purposes, property is considered placed in service when the asset is ready and available for use in its intended function.

Tax Software Survey

Consolidate multiple country-specific spreadsheets into a single, customizable solution and improve tax filing and return accuracy. The bill contains disaster provisions that extend rules for tax treatment of disaster-related personal casualty losses, excludes compensation for wildfire losses from income, and funds East Palestine, Ohio, disaster relief. The bill adjusts the child tax credit for inflation (rounded down to the nearest 100) in 2024 and 2025 and increases the partial refundability maximum for the child tax credit to 1,800 for 2023, 1,900 for 2024, and 2,000 for 2025. It bases the calculation for partial refundability on the number of children. We go through a 25-step review process for each and every casino we recommend, starting by ensuring that they have a proper license from a respected jurisdiction.

Get Help Maximize Bonus Depreciation And Section 179 Expensing

Electing to take bonus depreciation is often favorable for taxpayers seeking to minimize short-term tax liabilities. Though future year liabilities may be higher due to having a lower amount of bonus depreciation to claim, this may also create a net business loss that may be rolled over and carried to future years. There may be situations that make more sense to elect out of the program; for more information, consult your advisor to see whether you qualify for bonus depreciation and whether it strategically makes sense to claim. However, bonus depreciation may apply to higher spending amounts. Bonus depreciation is not capped in regards to dollars; an entire multi-million deduction for the entire cost of a single may be recognized in a single year. On the other hand, Section 179 deductions were limited to 1,080,000 for 2022 (based on 2,700,000 capital equipment spend).